Illuminating the Essence of Assets

In the realm of personal finance, the concept of assets holds profound significance, encapsulating the resources that carry value and contribute to financial strength. Yet, amidst the myriad of items we possess, it’s essential to discern what truly qualifies as an asset. To guide you through this financial labyrinth, let’s embark on an illuminating journey, uncovering which among these does not belong in the illustrious category of assets.

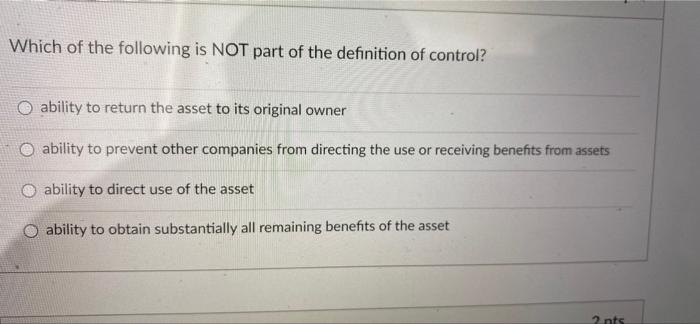

Image: www.chegg.com

Distinguishing Assets from Non-Assets

An asset is best understood as a resource with economic value that can be converted into cash or used to generate income. Real estate, stocks, bank accounts, and even tangible possessions like cars can all fall under this umbrella. Non-assets, on the other hand, are items that lack inherent monetary worth or the ability to provide financial gain. They may hold sentimental value or serve practical purposes, but they contribute little to building wealth.

Identifying the Non-Asset: Shedding Light on the Fallacy

Among the following items, one stands out as a non-asset:

- Credit card debt

This distinction is crucial because credit card debt represents an obligation, a liability that depletes your financial resources rather than augmenting them. Unlike assets, debt does not generate income or enhance your net worth; instead, it siphons off your hard-earned funds through interest payments and late fees.

Understanding the Anatomy of Debt

Credit card debt arises when you borrow money from a lending institution and use it to make purchases. While this may offer short-term convenience, it can lead to a slippery slope of financial entrapment. The high interest rates associated with credit cards can quickly balloon your debt, making it increasingly difficult to repay. Moreover, once credit card debt accumulates, it can negatively impact your credit score, further hindering your ability to secure favorable financial terms in the future.

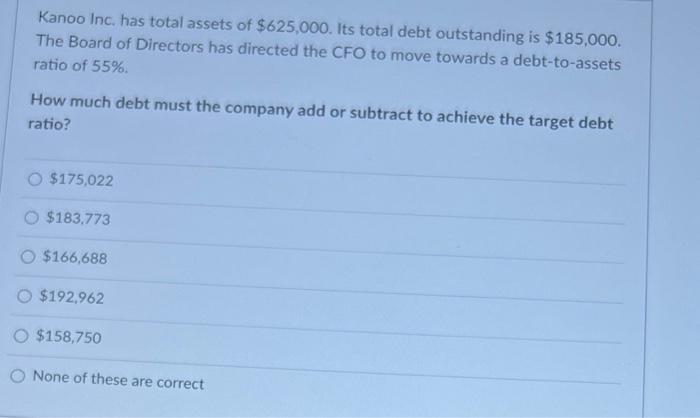

Image: www.chegg.com

Which Of The Following Is Not An Asset

https://youtube.com/watch?v=LZXff7arDIM

Breaking Free from the Debt Trap: A Path to Financial Liberation

If you find yourself entangled in credit card debt, it’s imperative to take immediate steps to regain control of your finances. Here are some proactive strategies to help you break free:

- Craft a Realistic Budget: Track your income and expenses to identify areas where you can reduce spending and allocate more funds toward debt repayment.

- Explore Debt Consolidation Options: Consider rolling your high-interest credit card debts into a lower-interest loan, potentially saving you significant money in the long run.

- Negotiate with Creditors: Contact your creditors and inquire about possible payment plans or debt settlements. While this may affect your credit score, it can provide much-needed relief from overwhelming debt.

- Seek Professional Help: If you’re struggling to manage your debt on your own, don’t hesitate to seek guidance from a certified credit counselor or financial advisor. They can provide personalized advice and support to help you develop a tailored debt repayment strategy.

Remember, breaking free from credit card debt is a gradual process that requires discipline and determination. Start small, stay motivated, and