In the labyrinthine world of business and legal frameworks, understanding the intricacies of legal structures is paramount. Each structure carries unique characteristics and implications that can significantly impact a business’s trajectory and liabilities. This article delves into the various legal structures, unraveling their descriptions and enabling you to make an informed decision for your enterprise.

Image: studylib.net

Legal Structures: The Bedrock of Business

A legal structure forms the foundation upon which a business operates, governing its ownership, liabilities, and tax obligations. Choosing the right structure is crucial as it can influence the level of control, financial exposure, and administrative demands placed on the company. Let’s explore the most common legal structures and their defining traits:

Sole Proprietorship: Ownership Simplified

A sole proprietorship stands as the simplest and most straightforward legal structure, where a single individual assumes full ownership and liability of the business. The entrepreneur enjoys sole decision-making authority, ease of setup, and maximum control. However, unlimited personal liability exposes the owner’s assets to business debts and obligations.

Partnership: Shared Responsibility and Expertise

A partnership involves two or more individuals pooling their resources to establish a business. Partners share ownership, decision-making, and profits but also bear joint and several liability, meaning each partner is personally responsible for the business’s debts and liabilities, regardless of their individual contributions.

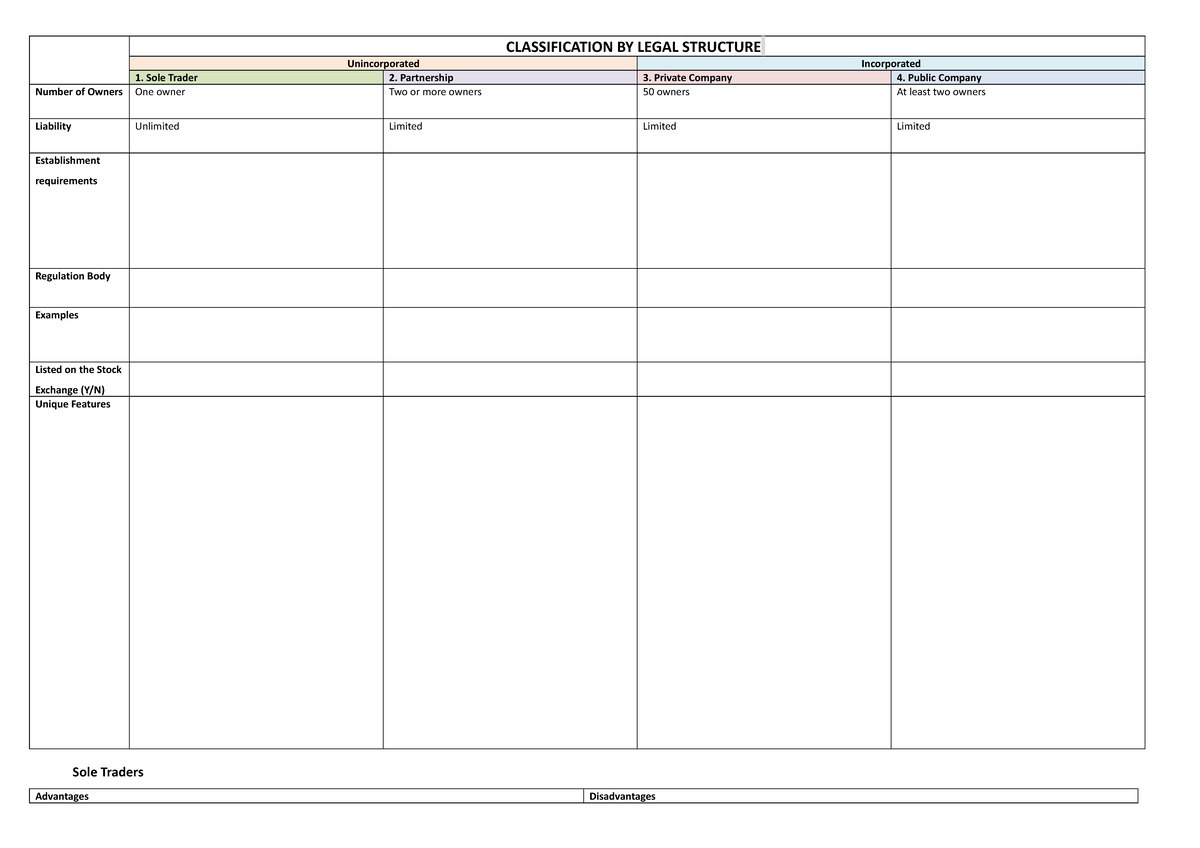

Image: www.studocu.com

Limited Liability Company (LLC): A Hybrid of Protection and Flexibility

An LLC combines elements of sole proprietorships and partnerships, offering limited liability to its owners while allowing for flexible management structures. LLC owners, known as members, have their personal assets shielded from business liabilities, but they may face pass-through taxation, where business income is taxed as personal income.

Corporation: A Distinct Legal Entity

A corporation stands as a distinct legal entity separate from its owners, offering the highest level of liability protection. Shareholders, who own shares of the corporation, hold limited liability, meaning their personal assets are not at risk in case of business debts or lawsuits. Corporations also offer greater opportunities for fundraising and expansion.

Choosing the Right Structure: A Critical Crossroads

Selecting an appropriate legal structure is intertwined with several factors that warrant careful consideration:

- Liability Protection: Prioritize structures that limit personal liability to safeguard personal assets from business-related claims.

- Tax Implications: Analyze the tax consequences of each structure to minimize tax burdens and optimize revenue.

- Control and Flexibility: Consider the level of control desired and the need for flexibility in management and decision-making.

- Expansion and Growth: Look ahead to future business aspirations and select a structure that supports potential growth and expansion.

In addition to understanding the descriptions and matching them with the correct legal structures, here are some expert insights and actionable tips to guide your decision-making process further:

- Consult with an attorney or business advisor to obtain personalized advice tailored to your specific business objectives.

- Research and explore various online resources to gather a comprehensive understanding of the legal structures available.

- Evaluate the potential implications of each structure on your business’s financial standing, flexibility, and liability exposure.

- Don’t hesitate to make changes to your legal structure as your business needs evolve over time.

Match The Legal Structure To Its Description

Conclusion: Empowering Informed Decisions

Navigating the legal complexities of business structures can be daunting, but understanding the descriptions and matching them with the corresponding structures empowers business owners to make informed decisions that serve their ventures best. By carefully assessing liability protection, tax implications, control and flexibility, and growth potential, entrepreneurs can select the legal structure that aligns with their aspirations and paves the path for future success.