A Journey into the Unseen: Understanding Fixed Costs

Imagine a boat setting sail into the vast ocean, its passengers unaware of the challenges that lie ahead. The ship’s captain, a seasoned navigator, knows that maintaining a steady course requires careful planning and a clear understanding of the hidden costs they face.

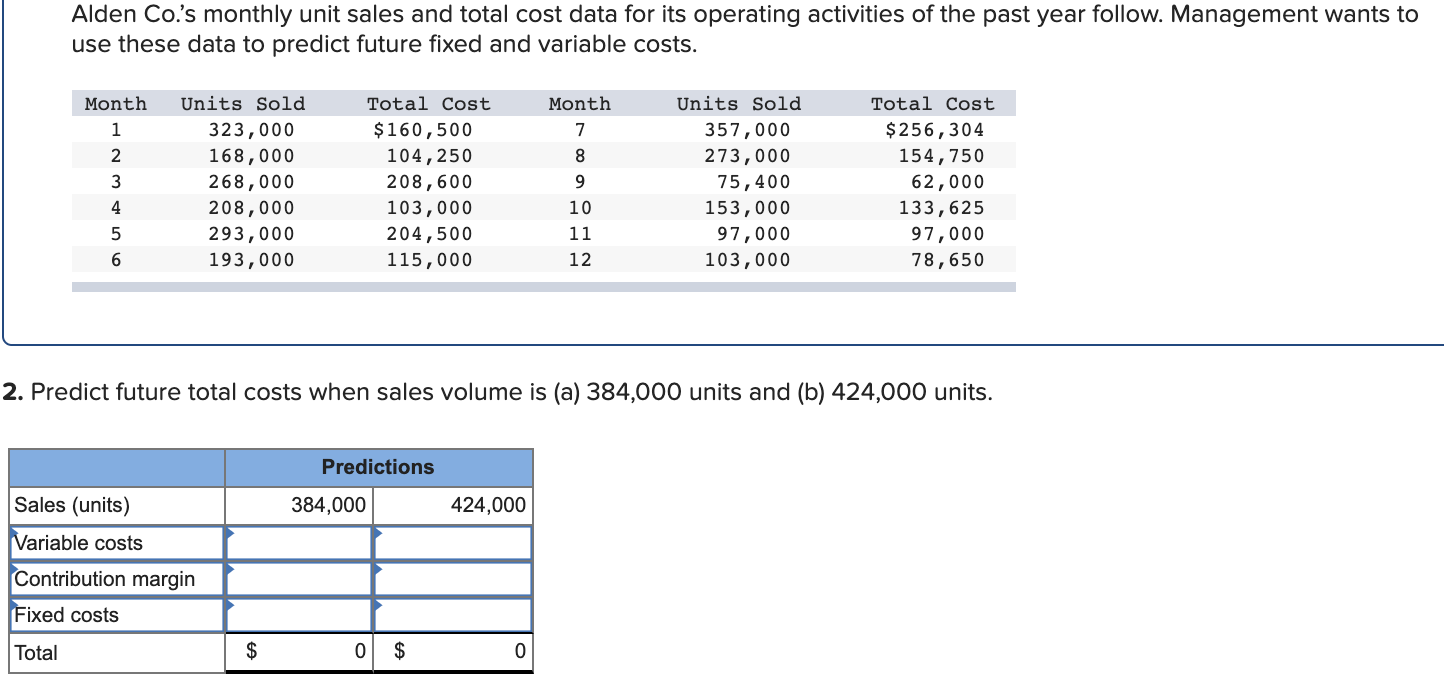

Image: www.chegg.com

In the world of business, companies face similar challenges, and one of the most significant is managing fixed costs. Like the constant hum of the boat’s engine, fixed costs remain unchanged regardless of the ups and downs of day-to-day operations. They are the unseen currents that shape a company’s financial destiny. Understanding and managing fixed costs is essential for navigating the turbulent waters of the marketplace.

Breaking Down the Components of Fixed Costs

Fixed costs are like the pillars that support a building, providing a foundation of stability amid the ebb and flow of revenue. These costs include:

- Rent and Utilities: The monthly rent paid for office space and the costs of utilities like electricity, water, and heating.

- Salaries and Benefits: The compensation and benefits packages for employees, regardless of their workload.

- Loan Repayments: Fixed payments made towards borrowed funds, such as business loans or equipment leases.

- Insurance Premiums: Payments for insurance policies that protect the company and its assets from unexpected events.

- Depreciation and Amortization: Non-cash expenses that account for the gradual decline in value of assets, such as office equipment or intangible items like patents.

The Impact of Fixed Costs on a Company’s Financial Health

High fixed costs can be both a blessing and a curse. While they provide stability during stable periods, they can also become a burden when the winds of change blow.

Advantages of High Fixed Costs:

- Stability and Predictability: Fixed costs offer a sense of financial stability, allowing companies to plan accurately and budget effectively.

- Efficiency: Having fixed costs allocated for essential expenses like rent and salaries ensures that operations run smoothly.

- Minimized Risk: Insurance policies and loan repayments provide a safety net, protecting companies from unforeseen events.

Disadvantages of High Fixed Costs:

- Increased Break-Even Point: Companies with high fixed costs require a higher volume of sales to break even, which can be challenging during downturns.

- Reduced Flexibility: Fixed costs limit a company’s flexibility to adjust expenses quickly in response to market fluctuations.

- Difficult to Reduce: Once fixed costs are established, they can be challenging to reduce without significant restructuring or layoffs.

Strategies for Managing High Fixed Costs

Despite the challenges, companies with high fixed costs can navigate the stormy seas if they employ sound financial management strategies.

- Negotiate and Renegotiate: Renegotiating terms for rent, utilities, and other contracts can help reduce expenses without sacrificing quality.

- Outsource and Lease: Consider outsourcing certain non-core functions or leasing equipment instead of purchasing them, freeing up capital to invest in revenue-generating activities.

- Automate and Innovate: Automation and technological advancements can streamline processes and reduce the need for additional staff, effectively cutting fixed costs.

- Flexible HR Policies: Hire employees under part-time or freelance agreements to adjust labor expenses in response to seasonal fluctuations.

- Plan and Forecast: Meticulous planning and forecasting enable companies to anticipate downtime and allocate resources efficiently, reducing the impact of high fixed costs during lean periods.

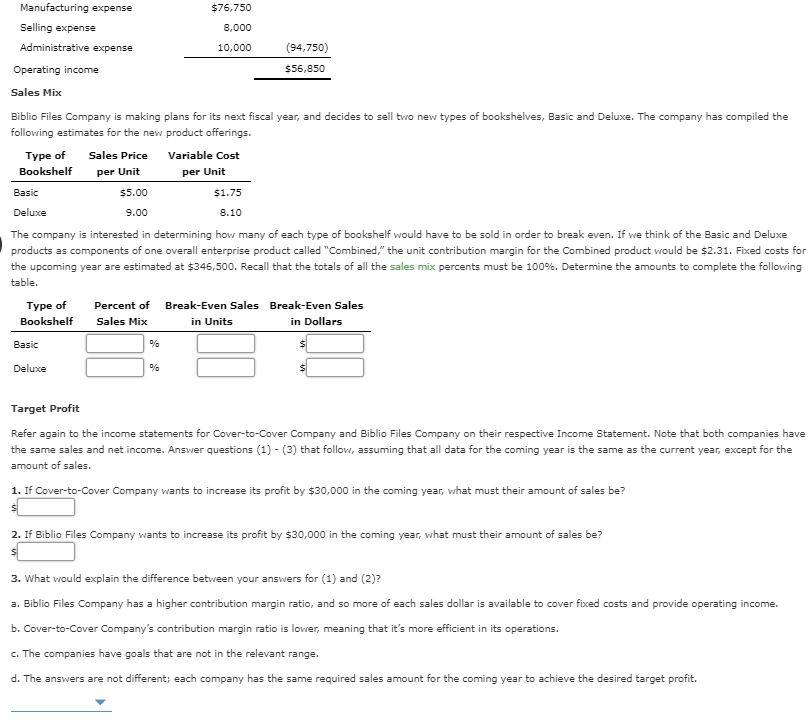

Image: www.chegg.com

A Company With A High Ratio Of Fixed Costs:

https://youtube.com/watch?v=i0DaL_vhjYU

Conclusion: Embracing Financial Agility Amidst Stability

就像那艘扬帆远航的船,拥有高固定成本的公司必须具备应对挑战的韧性和灵活性。通过理解固定成本的本质、管理策略和应对措施,企业可以将这些固定锚点转化为航行的帆。在变幻莫测的商业环境中,财务敏捷性和创造性思维将成为公司的风向标,引领他们驶向繁荣的港湾。