Financial Statements: Understanding the Order of Preparation

The balance sheet provides a static picture of a company’s financial position at a specific point in time, typically at the end of a reporting period. It presents a snapshot of the company’s assets, liabilities, and equity, revealing its financial structure. Assets represent what the company owns or has control over, while liabilities are its obligations. Equity showcases the residual interest claimed by the company’s owners, calculated as the difference between assets and liabilities. The balance sheet adheres to the fundamental accounting equation: Assets = Liabilities + Equity.

The Income Statement: Measuring Financial Performance

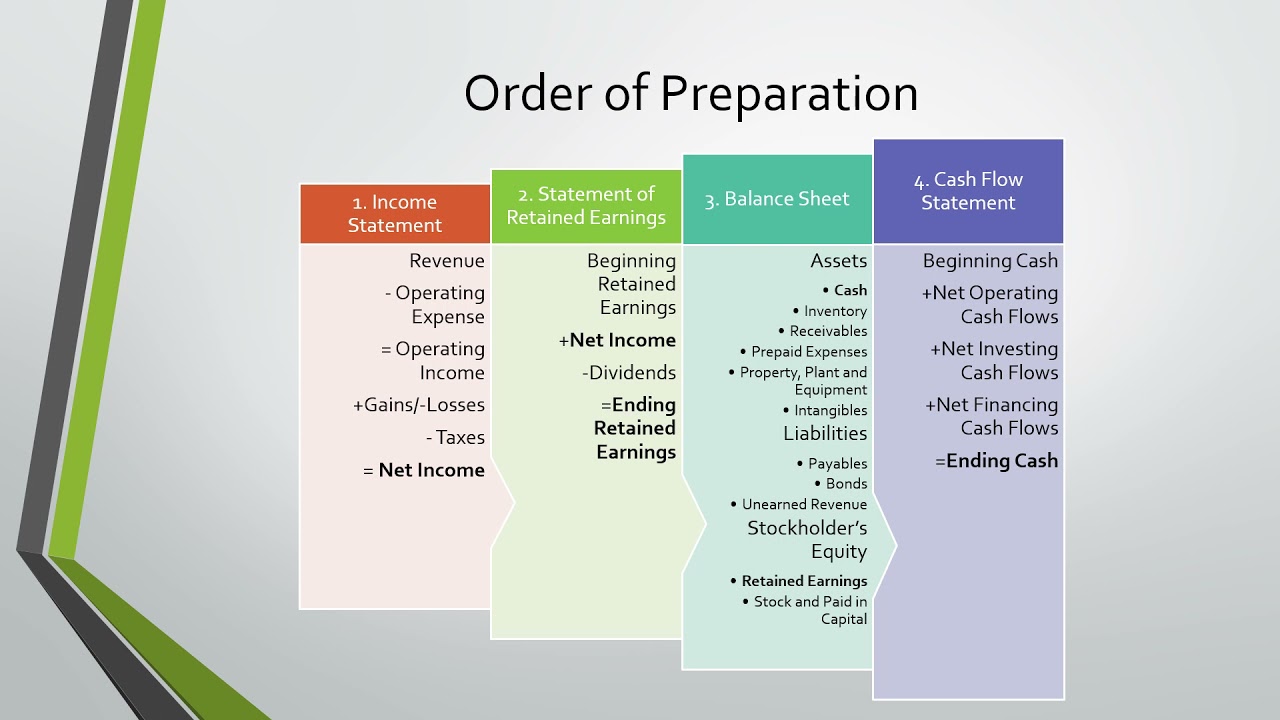

The income statement, also referred to as the profit and loss statement, is a record of a company’s financial performance over a specific period, typically a quarter or a year. It displays the revenue, expenses, and profits generated during the reporting period, providing insights into a company’s core business activities. The ultimate objective of the income statement is to determine the net income or loss, representing the profitability of the company’s operations.

The Statement of Cash Flows: Tracking Liquidity and Solvency

The statement of cash flows presents information about a company’s cash flows, separating them into their three primary activities: operating, investing, and financing. Operating activities involve the main cash inflows and outflows related to a company’s day-to-day operations. Investing activities consider transactions involving the purchase or sale of assets, while financing activities deal with cash flows from borrowing, issuing stocks, and repaying debt. By analyzing the statement of cash flows, users can assess a company’s liquidity and solvency, revealing its financial flexibility and potential sustainability.

Image: www.youtube.com

The Statement of Changes in Equity: Analyzing Ownership and Distribution

The statement of changes in equity details changes in the company’s equity, including retained earnings and other components affecting its net assets. It presents a detailed breakdown of shareholders’ equity, highlighting the transactions that have resulted in its increase or decrease during the reporting period. The statement of changes in equity offers valuable insights into the company’s capital structure, dividend policies, and retained profits, providing a better understanding of the funds invested by owners and how these funds were utilized.

Value and Purpose of Understanding the Order of Financial Statement Preparation

The order of preparing financial statements enhances the clarity and coherence of the information presented. By starting with the balance sheet, readers can establish a foundation of the company’s assets, liabilities, and equity. This understanding sets the context for the income statement, where the financial performance over a specific period is evaluated. The statement of cash flows provides an additional layer of insights by revealing how the company generates and utilizes cash, fostering a clear understanding of its liquidity and financial flexibility. Finally, the statement of changes in equity completes the picture by showing how the company’s equity has shifted, reflecting capital movements, investments, and profit distribution.

Comprehending the order of financial statement preparation equips users with a logical approach to analyzing a company’s financial stability and prosperity. Each statement builds upon the previous one, ensuring a sequential and interconnected framework for financial analysis. Whether evaluating a firm’s financial health for potential investment, assessing business performance for internal decision-making, or conducting industry comparisons to benchmark against competitors, grasping the proper sequence of financial statement preparation serves as a fundamental step towards accurate interpretation.

Financial Statements Are Typically Prepared In The Following Order

Conclusion

Financial statements are essential tools for investors, creditors, and managers to evaluate a company’s financial standing, determine its liquidity and profitability, and make critical financial decisions. By preparing these statements in the correct order – balance sheet, income statement, statement of cash flows, and statement of changes in equity – a transparent and cumulative picture emerges. This systematic flow allows for a coherent analysis and a precise understanding of a company’s overall financial performance and outlook.