Image: blanker.org

Navigating the complexities of filing a LDS 2221a form can be a daunting task. To ensure compliance and avoid potential legal implications, it’s crucial to understand the specific circumstances that trigger the need for this document. In this comprehensive guide, we will explore the ins and outs of when you must file a LDS 2221a form, empowering you with the knowledge to make informed decisions.

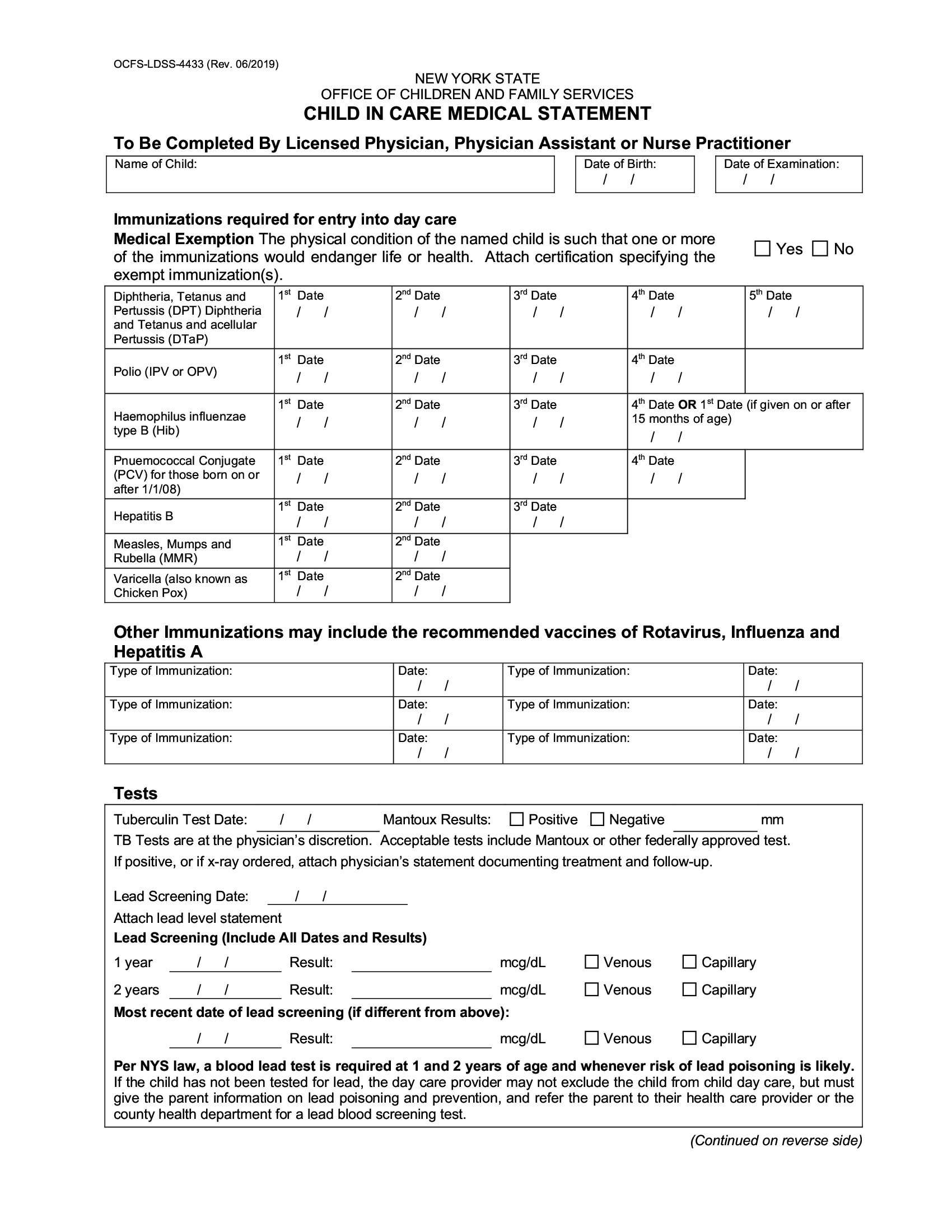

What is a LDS 2221a Form?

A LDS 2221a form is a legal document required by financial institutions to report certain financial transactions to the Internal Revenue Service (IRS). It is primarily used to track large cash transactions in order to combat financial crimes such as money laundering and tax evasion.

Filing Requirements

The LDS 2221a form must be filed whenever a financial institution engages in the following transactions:

- Cash purchases of negotiable instruments: Transactions where cash is used to purchase cashier’s checks, traveler’s checks, money orders, or bank drafts with a combined value exceeding $10,000.

- Cash receipts of more than $10,000: When a financial institution receives cash in excess of $10,000 from a single source in one business day.

- Certain cash and cash equivalent transactions: For businesses, cash equivalent transactions include investments, precious metals, and other assets that can be easily converted into cash. These transactions must be reported if they exceed $10,000 in aggregate.

Exemptions

Some transactions are exempt from the LDS 2221a filing requirement. These include:

- Government entities: Transactions involving federal, state, or local government agencies are exempt.

- Bank transfers: Electronic transfers of funds between financial institutions do not require reporting.

- Payroll and benefit checks: Payments made directly to employees or through third-party payroll providers are exempt.

Who Must File?

Financial institutions, including banks, credit unions, and money services businesses, are legally obligated to file LDS 2221a forms for eligible transactions.

Penalties for Non-Compliance

Failure to file a LDS 2221a form or providing incomplete or inaccurate information can result in civil penalties of up to $10,000 per violation.

Practical Consequences of Filing

- Enhanced due diligence: Financial institutions may perform additional customer due diligence procedures when filing a LDS 2221a form.

- Delay in transactions: Processing large cash transactions may be delayed while the financial institution investigates and files the necessary paperwork.

- IRS investigation: Failure to file or provide accurate information can trigger an IRS investigation into the underlying transactions.

Expert Advice

Understanding the filing requirements and potential consequences is essential for businesses and individuals who may engage in large cash transactions. Here are insights from financial experts:

- Keep accurate records: Document all large cash transactions to ensure accurate reporting and avoid discrepancies.

- Be prepared for additional due diligence: Be aware that filing a LDS 2221a form may trigger additional requests for information from financial institutions.

- Consult a qualified accountant: Seek professional advice to ensure compliance and mitigate potential legal risks.

Conclusion

The LDS 2221a form plays a vital role in combating financial crimes and ensuring financial transparency. By understanding the filing requirements, exemptions, and consequences, you can avoid legal complications and contribute to the integrity of the financial system. If you have any doubts or need guidance, consult a qualified expert for personalized advice.

Image: formspal.com

When Must A Ldss 2221a Form Be Filed