Which of the Following is an Example of Fraud?

Fraud can be broadly defined as any activity or representation intended to deprive someone of their rightful property or money by deceit or trickery. History is replete with numerous instances of fraudulent practices, from the forging of documents to the embezzlement of funds. Comprehending the nature and scope of fraud is essential for its effective detection and prevention.

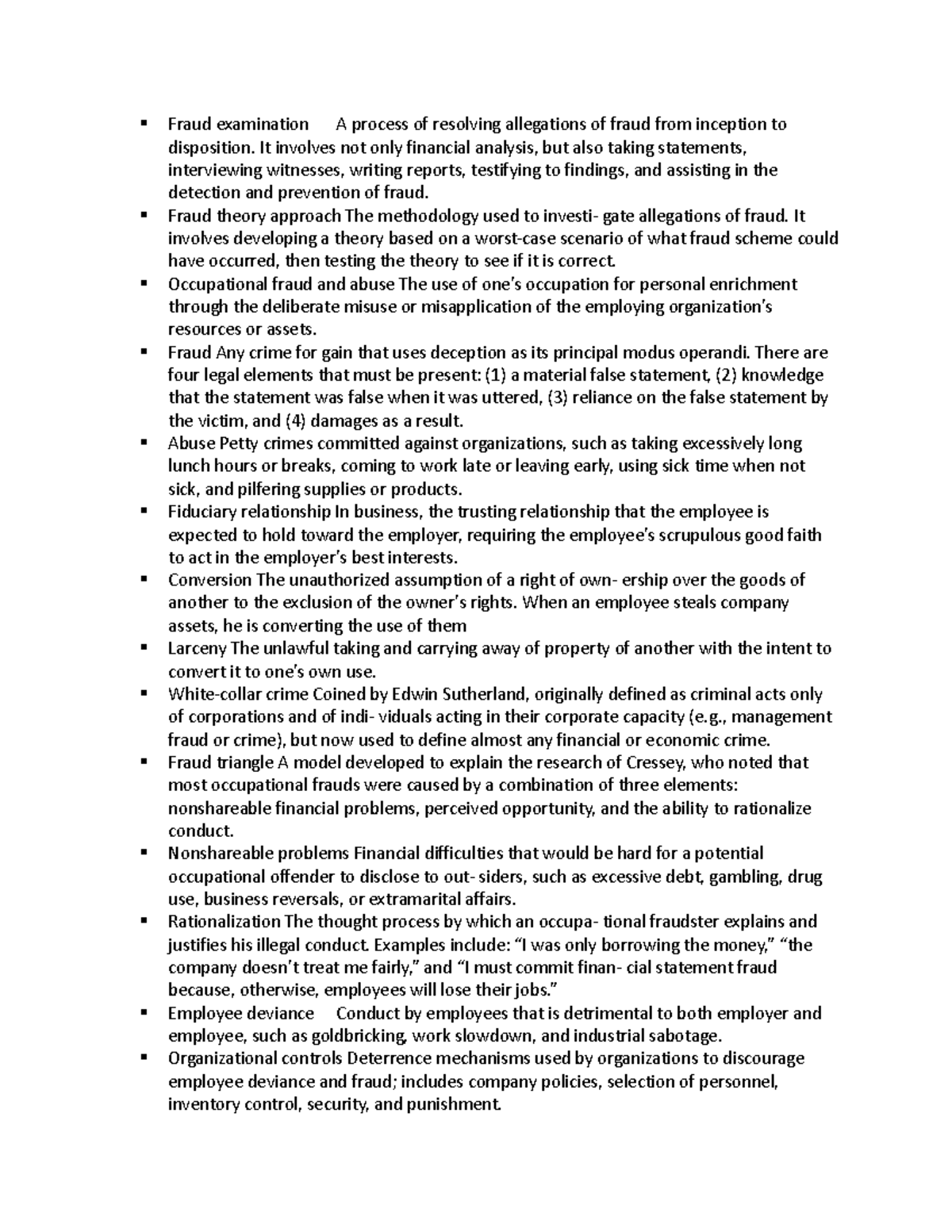

Classifying Fraud

Fraud can manifest in various forms, each with its unique characteristics. Common examples include check counterfeiting, creating fake identities for fraudulent purposes, using stolen credit cards, and diverting funds or property by misappropriating authority or trust.

Detecting Fraud

Spotting the red flags of fraud requires vigilance and awareness. Some telltale signs include requests for personal information under suspicious circumstances, inconsistent or falsified documents, unusual or irregular transactions, and requests to deviate from established procedures. By carefully scrutinizing such anomalies, we can proactively mitigate the风险 of falling prey to fraudulent activities.

Image: www.studocu.com

Protecting Against Fraud

Safeguarding ourselves from fraud necessitates a proactive approach. Educating ourselves on common schemes, exercising caution when receiving unsolicited requests, reporting suspicious activities promptly, and leveraging available security measures are effective ways to enhance our protection.

Expert Insights

“Fraud is an ever-present threat, but by understanding its different manifestations and employing effective preventive measures, we can safeguard ourselves from becoming victims,” advises Dr. Emily Carter, a leading expert on fraud detection. She underscores the importance of reporting suspected fraudulent activity to the appropriate authorities, as timely action can prevent further losses.

Frequently Asked Questions

Q: What should I do if I detect suspicious activity in my bank account?

A: Contact your bank and police immediately. Suspend the account and freeze the funds to prevent further losses

Q: Is online shopping more susceptible to fraud than traditional shopping?

A: While both avenues present some level of risk, online shopping may pose a higher risk due to the anonymity and ease of creating fake profiles

Q: Can businesses incur losses due to fraud?

A: Businesses are not immune to fraud. Employee theft, fraudulent invoices, and cybercrime are just a few examples of ways businesses can lose money due to fraud.

Which Of The Following Is An Example Of Fraud

Conclusion

Comprehending the definition and examples of fraud empowers us with the knowledge to protect ourselves from its detrimental consequences. Remember, fraud takes on various guises, evolves constantly, and can target individuals and businesses alike. By being informed, cautious, and proactive, we can collectively combat and mitigate this ubiquitous threat. Stay vigilant, and let’s work together to create a society where fraud has no place.

Are you interested in learning more about fraud? Share your thoughts, experiences, or questions in the comments below.