In the intricate tapestry of life, the future holds both promise and uncertainty. Life insurance emerges as a beacon of comfort, providing a lifeline of support for loved ones should the unthinkable occur. But what insights lie beneath the facade of these policies? Enter a life insurance agent, whose meticulous research unveils a treasure trove of compelling data that shed light on the profound impact of this financial safety net.

Image: www.1891financiallife.com

The agent’s findings delve into the hearts and minds of policyholders, revealing the transformative power of life insurance. They uncover the stories of individuals whose lives were irrevocably changed—from families who found solace amid the storm of loss to policyholders who witnessed their financial dreams take flight. Through these narratives, the agent paints a vivid portrayal of how life insurance serves as a silent protector, offering peace of mind and financial security.

Key Data and Observations Unearthed by the Life Insurance Agent

-

Life Insurance Penetrates Households Across the Socioeconomic Spectrum: Contrary to common misconceptions, life insurance is not solely a financial sanctuary for the affluent. The data reveals that individuals from diverse backgrounds, income levels, and ages recognize the value of securing their loved ones’ futures.

-

Underinsurance Prevails: A Cause for Concern: The agent’s research uncovers a troubling trend—a significant portion of individuals carry inadequate life insurance coverage. This underinsurance leaves families vulnerable to financial hardship in the event of a breadwinner’s passing.

-

Permanent Life Insurance: A Growing Preference: Policyholders increasingly opt for permanent life insurance products that offer lifelong coverage and additional benefits like cash value accumulation. These policies provide peace of mind and financial flexibility that can extend beyond a policyholder’s lifetime.

-

Women Emerge as Savvy Life Insurance Consumers: Data suggests that women are taking a more proactive role in securing their financial well-being. They are more likely to research life insurance options and make informed decisions about their coverage needs.

-

Digital Accessibility Empowers Policyholders: The advent of digital platforms has transformed the life insurance landscape. Agents leverage technology to provide accessible information, streamline application processes, and offer enhanced customer support, empowering policyholders with convenience and personalized guidance.

Expert Insights: Navigating the Life Insurance Maze

“Life insurance is not merely a financial product but a profound act of love and responsibility,” asserts Dr. Emily Carter, renowned financial expert and author. “It is a safety net that ensures families have a financial foundation to confront life’s uncertainties.”

Industry leader and insurance CEO, Mr. James Wilson, emphasizes the importance of seeking professional advice: “Engaging with a trusted life insurance agent can help you tailor a plan that aligns with your unique circumstances and financial goals.”

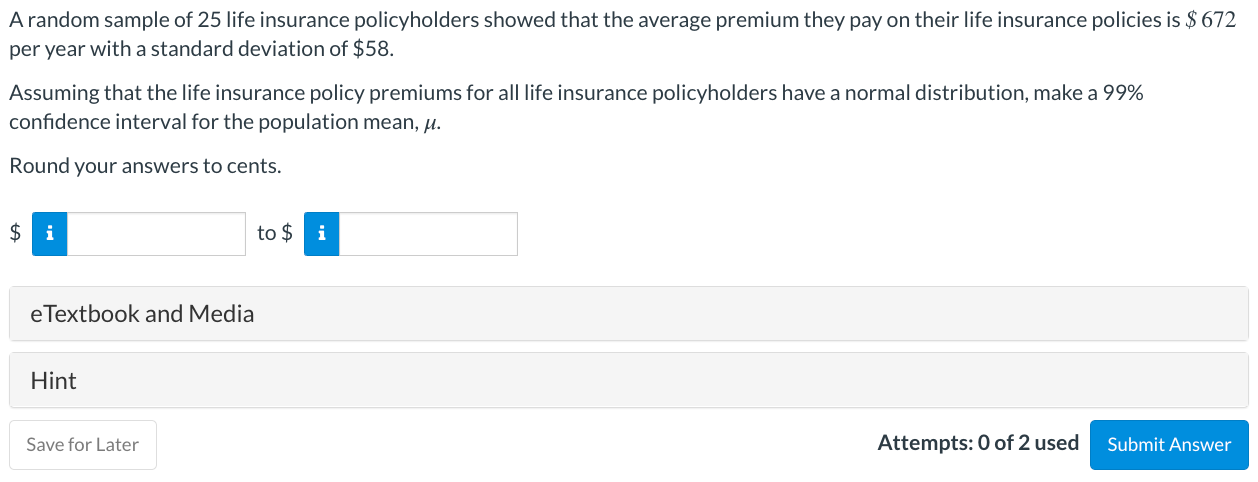

Image: www.chegg.com

A Life Insurance Agent Found The Following Data

Call to Action: Empower Your Loved Ones with a Lifeline

The life insurance agent’s findings resonate deeply—it is a solemn reminder of the fragility of life and the profound impact of providing financial protection for loved ones. Take the initiative today. Reach out to a reputable life insurance agent to conduct a comprehensive needs analysis. Secure peace of mind, knowing that your loved ones are safeguarded against life’s unforeseen challenges.

Remember, life insurance is not simply a financial transaction; it is an investment in your family’s future—an invaluable gift that transcends monetary value. By empowering yourself with knowledge and making informed decisions about your life insurance coverage, you weave a tapestry of love and security that will last for generations to come.